Тема: Company Finance

Цель урока:

учебная – совершенствование лексических навыков по теме «Shares and Stocks in the UK»; формирование лексических навыков по текущей теме;

познавательная – понятие о способах формирования финансов компании

Тип урока: комбинированный

1. Вопросы по теме «Shares and Stocks in the

1. Into what is the capital of a limited company divided?

3. What two types of shares do you know?

4. What do you know about ordinary shares? preference shares?

5. What do you know about deferred ordinary shares? cumulative preference shares, participating preference shares?

6. What is the difference between shares and bonds?

7. What is a cheque?

8. What do we call stocks?

9. Are stocks divisible? What does it mean?

2. Найдите соответствия

|

1. Shares |

Отсроченная обыкновенная акция |

|

2. Divisible |

Привилегированная акция |

|

3. Ordinary share |

Делимый |

|

4. Deferred ordinary share |

Пай |

|

5. Preference share |

Иметь фиксированную ставку дивиденда |

|

6. Cumulative preference share |

Единицы различного достоинства |

|

7. Participating preference share |

Например |

|

8. Carry a fixed rate of dividend |

Обыкновенная акция |

|

9. Stock |

Сумма чистой прибыли |

|

10. Units of various value |

Части |

|

11. Amount of net profit |

Привилегированная акция с участием |

|

12. Earned by the company |

Акции |

|

13. For instance |

Заработанный компанией |

|

14. Fractions |

Кумулятивная привилегированная акция |

3. Вставить слова по смыслу (на оценку)

1. Companies usually ______________its capital into shares. (divide)

2. Shares may be in _____________of various value. (units)

3. _______________ shares carry no fixed rate of dividend. (ordinary)

4. _______________shares carry a fixed rate of dividend. (preference)

5. Units of 100 shares are known as ______________(stocks)

6. Stocks are _______________(divisible)

7. _____________ of stocks can be bought and sold. (fractions)

8. _________________shares give their shareholders additional privileges. (preference)

9. You receive a dividend dependent on the amount of net profit earned by the company. What type of shares do you own? (ordinary)

10. ________________ shares allow you to accumulate your dividends. (cumulative)

11. ________________ordinary shares give you the right to get dividends only in a certain period of time. (deferred)

12. _________________preference shares combine the features of ordinary shares and preference shares. (participating)

4. Новая тема «Company finance». Презентация слов

|

1. Share capital (equity capital, joint stock capital, stock) |

Акционерный капитал |

|

|

2. face value |

Нарицательная стоимость (номинал – официальная цена, указанная на акциях) |

When shareholders sell their shares they get more or less than the face value. It depends on the current situation in the company, if it does well or badly. |

|

3. to raise capital |

Получить (добыть) капитал |

Companies issue shares to raise capital for expansion. |

|

4. to expand (expansion) |

Расширяться (расширение) |

|

|

5. to issue shares |

Выпускать акции |

|

|

6. Rights issue |

Выпуск акций для размещения среди существующих акционеров |

If the company issues shares, shareholders can buy them at a lower price. It is rights issue. |

|

7. Bonus (capitalization) issue [‘bqVnqs] |

Выпуск бесплатных акций (эмиссия бесплатных акций) – бонусная эмиссия акций. |

If the company wants to turn some of its profits into capital or capitalize some of its profits, the company makes a bonus issue (issues shares at no cost to the existing shareholders). In this case the company gives shares to shareholders instead of dividends. |

|

8. to supply with finance |

обеспечить финансами |

Business must be supplied with finance at the moment it requires it. |

|

9. to require finance (requirements) |

нуждаться в финансах (требовать финансы) – требования |

|

|

10. inflow of receipts [rI’si:t] |

Приток денежных поступлений |

Much time elapses between inflow of receipts and outflow of payments. Banks assist businesses to cover a deficit. Banks grant credits. |

|

11. outflow of payments |

Отток денежных средств |

|

|

12. to elapse |

Проходить (о времени) |

|

|

13. to assist smb. |

Помогать кому-либо |

Вопросы по словам

1. What are the synonyms to the expression share capital?

2. What is a face value? – It is an official price which stands on shares.

3. If you want to expand, in what way will you raise capital?

4. What is rights issue? - The company issues shares and sells them to shareholders at a low price.

5. What is a bonus issue? - Companies don’t pay dividends, they issue shares and give them to shareholders free.

6. When is business successful? When inflow of receipts is higher than outflow of payments.

7. What business organizations assist companies if outflow of payments is not equal to inflow of receipts? – Banks.

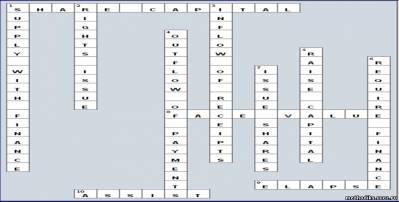

5. Решить кроссворд

|

Across |

Down |

|

1. акционерный капитал |

1. обеспечивать финансами |

|

8. нарицательная стоимость |

2. выпуск акций для размещения среди существующих акционеров |

|

9. проходить (о времени) |

3. приток денежных поступлений |

|

10. помогать |

4. отток денежных средств |

|

|

5. получить (добыть) капитал |

|

|

7. выпускать акции |

Ответы

A company’s share capital is often referred to as equity capital. Part of the company’s profit is paid to shareholders as a dividend according to the number of shares they own. If shareholders sell their shares they get more or less than the face value. It depends on the fact if the company is doing well or badly.

If the company needs to raise more capital for expansion it might issue new shares. Often it gives existing shareholders the right to buy these new shares at a low price. This is called rights issue.

If the company wants to turn some of its profit into capital or capitalize some of its profit it can issue new shares at no cost to the existing shareholders. This issue is called bonus or capitalization issue. Companies often issue such shares instead of paying dividends to the shareholders.

A business must be supplied with finance at the moment it requires it. If there is a regular inflow of receipts from sales and a regular outflow of payments for the expenses of operation there are no serious problems. But in many cases a considerable time must elapse between expenditure and the receipt of income. It is the purpose of financial institutions to assist in the financing of business during this interval. Business companies turn to the capital market and the commercial banks to assist them.

7. Найдите предложения в тексте о дивидендах, выпуске акций для размещения среди акционеров, бонусном выпуске, финансовых институтах.

8. Что вы предпочтете?

putting the money under the mattress

putting the money in a bank

buying gold

buying shares

buying a car

buying a lot of lottery tickets

buying a small country house

travelling around the world

travelling to the States

9. Грамматика

10. Домашнее задание

1. Выучить слова

2. Уметь рассказывать по ключевым словам о капитале компании.